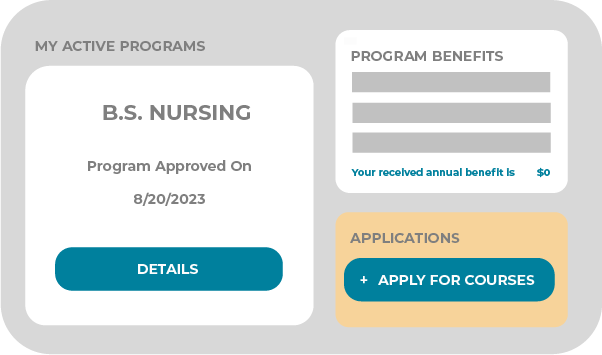

Create purposeful career pathways

Our approach to Tuition Assistance is to create plan designs that accelerate development and build skills in those areas that qualify your employees for the in-demand roles you need to fill.

We provide a paperless experience for employees and administrators, including custom approval workflows, document verification, and Section 127 compliance. To inspire participation, we have direct pay and deferred payment options, and provide education mentorship to employees.

Learn more about our Tuition Assistance platform>>>

Select an option below:

- Tuition Assistance

- Student Loan Wellness

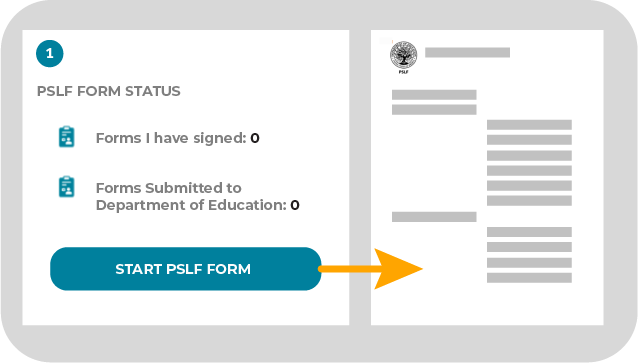

- PSLF

- Student Loan Repayment

- Secure 2.0 Match

Student loan contributions, tax-free.

All employers can provide a tax-free contribution to their employees' qualified student loans (up to $5,250 per year). Our platform provides tools and tracking for employees, and administers payments and compliance tracking for employers.

This benefit comes with our Wellness platform and unlimited loan coaching for employees and family members.

Lower payments now, loan forgiveness later.

Non-profit employees can lower monthly payments now and get full Public Service Loan Forgiveness (PSLF) after 10-years of service. But most eligible employees aren't aware, delay starting, or make mistakes --- leaving real money on the table.

Our tools and loan coaching engage staff, help avoid over 90% of the common mistakes, and create a compelling reason to stay with you. We also automate annual employment certification for you. Learn more>>>

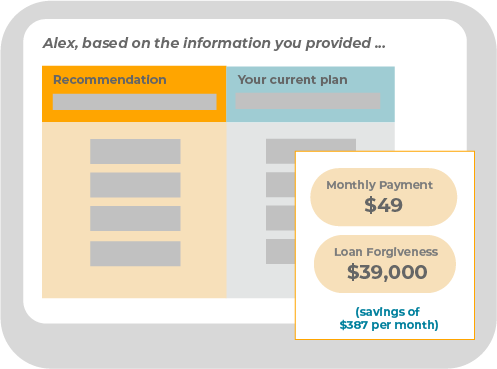

Student loans, simplified.

Our capstone Student Loan Wellness platform helps employees find the best way to repay their student loans through diagnostic tools, helpful resources, and expert coaching.

We also supports college planning with ROI tools at the college and degree level, recommendations to best fund college, and FAFSA support. And did we mention family invites are included?

Tuition assistance, done right.

Our end-to-end Tuition Assistance administration platform supports custom plan designs, approval flows and direct pay, deferred pay, and reimbursement models. It also comes with unlimited education mentorship for your employees, and access to tuition reductions through our Learning Partner Network.

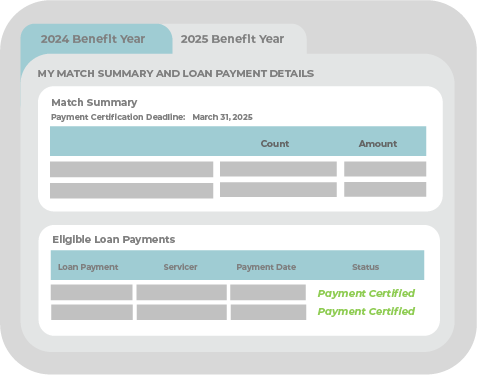

Secure 2.0 retirement match, game changer.

Enable employees struggling to pay back student loans a way to save for retirement, and help solve a top financial worry for most people working today. Our Secure Your Future platform is configurable, and includes compliance, payment certification, reports, and decision support tools.

This benefit comes with our Wellness platform and unlimited loan coaching for employees and family members.

Grow your workforce where it matters

Student loan debt support and tuition assistance benefits can help solve your workforce challenges.